Newmark Warrnambool Property Trust

Trust Status: Open for Investment – Limited Amount of Units Available for Investment

The Newmark Warrnambool Property Trust (Trust) owns Gateway Plaza Shopping Centre (Gateway Plaza or the Centre), a dominant sub-regional shopping centre in the strong and growing economy of Warrnambool, Victoria. The Centre offers a range of basic needs retail uses and services in a gateway location on the eastern edge of Warrnambool, and is forecast to deliver Investors a distribution yield of 8.0% net of fees for the year commencing 1 July 2024, with tax deferred benefits.*

8.0% p.a.

Forecast distribution yield net of fees 1 July 2024 to 30 June 2025, which is forecast to be 95% tax deferred*

15% p.a.

Target IRR over the balance of the 4.25 year investment term*

Reliable Basic Needs Retail Centre

In major regional economy by income

Experienced and Proven Manager

Property Features

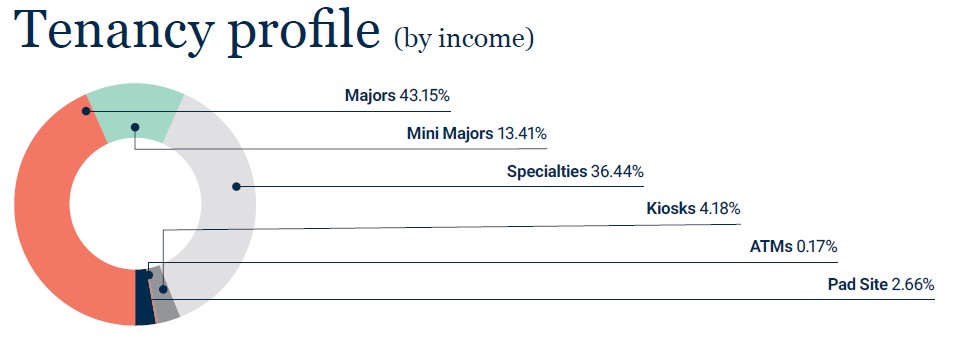

Significant income weighting to major national and chain retailers

Anchored by Coles, Kmart and Aldi, which together occupy 63% of the gross lettable area (GLA). The centre offers national and chain retailers including food, fashion and services that account for 95% of the GLA.

Major regional service centre

Warrnambool is the major service centre in the south western region of Victoria. Employment strengths are in the service sectors of retail, education, trade and tourism, health and community, food processing and government.

Value add opportunities

There are opportunities to create pad sites for other retailers outside of the centre in the car park area which we are actively working on, and is incremental to our forecasts. Also, our analysis suggests that a number of the specialty retailers are currently on below market occupancy costs. Newmark intends to deliver positive rental growth upon renewing these leases and has already secured additional incremental rent compared to forecast.

Major government infrastructure investment

This includes the Warrnambool rail line upgrade between Warrnambool and Geelong for an estimated cost of $251.85 million and the $384.2 million redevelopment of the Warrnambool Base Hospital expected for completion in 2026.

Prominent location

The centre is prominently positioned on the Princes Highway and is the primary shopping centre in Warrnambool. It is well located in the middle of Warrnambool’s eastern activity district and at the doorstep of the region’s housing growth corridor.

99% leased sub-regional shopping centre

Prominent shopping centre with 17,930.10 sqm of gross lettable area across ~44 tenancies. Convenient parking for 926 vehicles enhances accessibility.

Anchored by Major Tenants

Anchored by Major Tenants

![]()

![]()

Mini Major Tenants

Mini Major Tenants

![]()

![]()

![]()

National Tenants

National Tenants

Investment Overview

| Trust name | Newmark Warrnambool Property Trust (‘Trust’) |

| Trust objective | The investment objective of the Trust is to pay Unit holders regular quarterly income distributions with potential for capital growth over the medium to long-term. The Trust is also expected to provide tax deferred benefits. |

| Investment strategy | The Trust owns Warrnambool Gateway Plaza Shopping Centre, an established and strong-performing investment property.

To enhance the income and capital value of the investment property, Newmark will:

|

| Open to | Wholesale clients only. The Trust is not open to retail clients. |

| Distributions | Quarterly, paid within six weeks after the quarter end. The forecast distribution yield to be paid to investors for the period from 1 July 2024 to 30 June 2025 is expected to be 8.0% p.a. net of fees and 95% tax-deferred.* |

| Target Internal Rate of Return (IRR) | 15% p.a. over the balance of the investment term* |

| Financing | The Trust has executed a debt facility with a major Australian bank. The Trustee has entered into interest rate hedging arrangements for 100% of the Trust’s interest rate exposure for almost three years, which is co-terminus with the debt facility.

The loan to value ratio of the Trust is 49.4%. |

| Exit strategy | The primary exit strategy for the Trust is divestment of the property at the expiry of the remaining investment term in 4.25 years, unless extended by a special resolution of Unitholders, or unless sold prior. |

| Initial Investment Term | 4.25 years. It is not expected that liquidity will be available during the Investment Term. |

| Trustee | Newmark Capital Limited (‘Newmark’) ACN 126 526 690, AFSL 319372 |

* Distribution and IRR forecasts are not guaranteed and are subject to assumptions, risks and uncertainties detailed in the Information Memorandum. Key risks are summarised below in “What are the Risks?”. Refer to the Important information below.

Property Overview

| Property | Gateway Plaza Shopping Centre, Warrnambool |

| Major tenants | Coles (3,078m²), Kmart (6,659m²), Aldi (1,621m²) |

| Mini major tenants | Chemist Warehouse, Best&Less, The Reject Shop |

| Other tenants | 31 specialty shops, 5 kiosks, 2 ATMs and 2 pad sites |

| Gross lettable area (GLA) | 17,930.10m² |

| WALE | 2.63 years weighted average lease expiry by gross income as at 31 December 2024 |

| Occupancy | 99.7% by gross lettable area (GLA) |

| Car parking | 926 spaces |

What are the risks?

All investments carry risk. It should be recognised that there are risks associated with an investment in the Trust which may, either directly or indirectly, impact on the returns and viability of the Trust. Before deciding whether to subscribe for Units, you should obtain and read the Information Memorandum in full and consider whether an investment in the Trust, whose underlying asset is retail property, is suitable for you. The risks associated with investing in Trust include, but are not limited to, the following:

Property risks – including non-performance by tenants, competitions with existing or new retailers, leasing, renewal and vacancy risks, development risks and unplanned capital expenditure risks, all of which may decrease Trust income or impact the capital value of the Centre and an investment in units of the Trust.

Financial risks – including gearing which magnifies risks and returns and associated risks related to interest costs and refinancing of the debt facility on expiry. Valuation, forecast variability and insurance risks also exist.

General and economic risks – including changes in economic conditions, liquidity, public health and pandemics, regulatory changes and settlement risks.

Suitable for:

Important Information

This information has been prepared by Newmark Capital Limited ACN 126 526 690 AFSL No. 319372 (‘Newmark Capital’) as trustee of the Newmark Warrnambool Property Trust. The information contained in this document is current only as at the date it is issued or as otherwise stated herein.

This information may not be reproduced or distributed without Newmark Capital’s prior written consent.

This information is not an offer or invitation in respect of units in the Trust. This information contains selected information and should be read in conjunction with the Information Memorandum for the Trust which is available to wholesale investors only. The Information Memorandum includes important information about the Trust including benefits and risks of an investment. Newmark Capital accepts no responsibility for the accuracy of statements, which are based on information and research published by third parties. This information may include photographs and illustrations that are indicative only and which may be subject to change. Newmark Capital does not give any representation or guarantee that any particular results will actually occur and reserves the right to change any design or statement contained in this information without notice to you.

This information is not personal investment or financial product advice and is not intended to be used as the basis for making an investment decision. Newmark Capital has not considered the investment objectives, financial situation or particular needs of any particular reader. You should consider your own financial situation, objectives and needs, conduct an independent investigation of, and if necessary obtain professional advice in relation to, this document and the Information Memorandum. The offer of units in the Information Memorandum is only open to wholesale clients, and is not available to retail clients, as those terms are defined in the Corporations Act 2001 (Cth).

This information does not purport to contain all the information that may be required to evaluate an investment in the Trust. Before investing, you should conduct your own independent review, investigations and analysis of the Trust and of the information contained, or referred to, in the Information Memorandum and, where necessary, consult your professional advisors. None of Newmark or its related entities and directors, officers, employees, agents, advisers, associates or representatives (Newmark Group) make any representation or warranty, express or implied, as to the accuracy, reliability or completeness of the information contained here or provided to you by any members of the Newmark Group, including, without limitation, any physical descriptions, historical financial information, estimates and projections and any other financial information derived from such information, and nothing contained in this information is, or shall be relied upon, as a promise or representation, whether as to the past or the future.

All statements of opinion and/or belief and all views expressed and all projections, forecasts or statements relating to expectations regarding future events or possible future performance of the Trust represent Newmark’s assessment and interpretation of information available as at the date of this information. Further, any projections or other estimates of returns or performance are based on certain assumptions that may change. No representation is made or assurance given that such statements, views, projections or forecasts are reasonable or correct or that the objectives or prospective returns of the Trust will be achieved. The forward-looking statements included here involve subjective judgment and analysis and are subject to uncertainties, risks and contingencies, many of which are outside the control of, or are unknown to, the Trustee and Investment Manager. Actual future events may vary materially from the forward-looking statements and the assumptions on which those statements are based. You must determine for yourself what reliance (if any) you should place on such statements, views, projections or forecasts and no responsibility is accepted by the Newmark Group. You are strongly advised to conduct your own due diligence. Past performance is not a reliable indicator of future performance.

All amounts shown on this page are in Australian dollars unless otherwise stated.